(6 minute read)

Remember that $10 or $12 you spent watching a movie in New York? That money is part of the big ocean of cash that is being passed between movie theaters and movie distributors, the latter that many have heard of but don't know what they're about.

Interactive Visual (Refresh the page if it doesn't load):

During the pandemic, Universal not only announced the release of their new streaming service, Peacock, they also just made public that there will be a reboot of Scarface (1983). Last year Universal also distributed 21 films, the most out of any distributor in 2019. It's clear from these actions that the company is looking to expand many parts of its business to compete with Warner Bros and Disney.

While Revenue per Film has shown a decline over the past 3 years, Universal's ambition may soon yield some very interesting results content and technology-wise.

Sony Pictures, the next closest competitor, has had a relatively flatter curve in terms of Revenue per Film, which shows they are consistent and makes them a safe bet. While the data suggests they are likely to maintain this decent trend of $75 million average box office revenue per movie per year, it doesn't appear like it's heading in any dramatic direction.

We all love a good Spider-Man movie as much as the next guy, and Sony Pictures has distributed a lot of great content over the years: A Beautiful Day in the Neighborhood (2019) and Casino Royale (2006) to name a couple. Perhaps the 18 films they distributed in 2019, the most since 2012, is a sign of growth, and it is also impressive to see that they have maintained a strong 3rd place position behind Warner Bros and Walt Disney for 15 straight years.

"...the M&A opportunity lies not within technology or a specific industry, but at the intersection of them both"

Remember that $10 or $12 you spent watching a movie in New York? That money is part of the big ocean of cash that is being passed between movie theaters and movie distributors, the latter that many have heard of but don't know what they're about.

Movie distributors connect you to the movies you want to watch and are responsible for handling much of the business side of filmmaking that comes before and after movie production. This work may involve negotiating contracts with theaters like AMC and Regal Cinemas and coordinating marketing campaigns.

You've probably seen these companies before from their 10-second intro videos. The one I always love is the MGM introduction of a Lion roaring at you from within that small ribbon window.

Two of the most prominent companies, Walt Disney Pictures and Warner Bros., have grossed the most revenue out of any distribution company thus far. And while there are hundreds of distributors out there, the ones you should know make up the Big Six. Let's turn to The-Numbers (TM) for some intel.

|

| The Pregame |

Two of the most prominent companies, Walt Disney Pictures and Warner Bros., have grossed the most revenue out of any distribution company thus far. And while there are hundreds of distributors out there, the ones you should know make up the Big Six. Let's turn to The-Numbers (TM) for some intel.

The Big Six before it became the Big Five

Hollywood's fame and fortune have become one of America's top calling cards. Americans are famous for their world renowned movies, and an Academy Award is considered the most prestigious of all professions in the film industry.

The most noteworthy distributors are as follows – in order of Total Box Office Revenue to date:

The most noteworthy distributors are as follows – in order of Total Box Office Revenue to date:

- Walt Disney Pictures

- Warner Bros.

- Sony Pictures

- Universal Pictures

- 20th Century Fox (Now under The Walt Disney Company but will include for this analysis)

- Paramount Pictures

Note that Netflix, Amazon Prime, and Hulu are not included on this list because they operate independently – only online and not in theaters. Together these six companies make up 77.51% of the total film distributor market, and the leftover 22.49% is shared among 869 other film distributors with the highest share belonging to Lionsgate at 4.07%.

A Tale as Old as 1995

Since 1995, The-Numbers.com has been collecting box office data by film for all of these companies and the rest of the 22.5% of the market.

From 1995 on we can start analyzing trends and see where each movie studio is headed. Below is a snapshot of box office revenue by each of The Big Six film distributors from 1995-2019.

The first row shows the number of films distributed each year while the second shows the total box office revenue PER film that year. The last row displays the cumulative box office revenue from that time frame – 1995 on. You can interact with the chart below the video. Notice who stands out at the end. 🐭

From 1995 on we can start analyzing trends and see where each movie studio is headed. Below is a snapshot of box office revenue by each of The Big Six film distributors from 1995-2019.

The first row shows the number of films distributed each year while the second shows the total box office revenue PER film that year. The last row displays the cumulative box office revenue from that time frame – 1995 on. You can interact with the chart below the video. Notice who stands out at the end. 🐭

Interactive Visual (Refresh the page if it doesn't load):

Does Quantity mean Quality?

Before we dive into the individual companies and celebrate Disney's success, I wanted to quickly investigate what Quality (Box Office Revenue Volume) versus Quantity (Movie Volume) would look like. After all, more movies should mean more revenue right? But how does this differ across companies?

When we plot the data, we can see that Walt Disney Pictures' successes over the last few years were definite outliers. 2016, 2018, and 2019 only produced around 10 films but box office revenue far exceeded what would have been called "expected results for a film studio" over the past 25 years. Nonetheless, we will proceed to fit a model.

When we plot the data, we can see that Walt Disney Pictures' successes over the last few years were definite outliers. 2016, 2018, and 2019 only produced around 10 films but box office revenue far exceeded what would have been called "expected results for a film studio" over the past 25 years. Nonetheless, we will proceed to fit a model.

Fitting a logarithmic model and forcing the y-intercept to zero gives us a simple model that is a strong fit to the data (R-squared of 83.5%). There is definitely a positive correlation.

When we exclude Walt Disney's ridiculously impressive performance, it expectedly yields an even better fit: R-Squared of 89.3%. We can confirm that thus more films distributed generally mean more money.

When we exclude Walt Disney's ridiculously impressive performance, it expectedly yields an even better fit: R-Squared of 89.3%. We can confirm that thus more films distributed generally mean more money.

#RaiseTheCurve

Still what is more important than quantity for businesses should be the quality as evidenced by Disney. The goal of a company should be less about flipping a coin on a production, hoping its seventh sequel will be as successful as the first, and more about Raising the Curve.

Notice the gaps below between Walt Disney (Light Blue curve at the top) and Warner Bros (Dark Blue curve in the middle), and then between those two companies and everyone else.

It really took Disney those six years of huge and outlandish blockbuster hits (2014-2019) to raise Disney's Box Office Revenue curve to almost a half billion dollar increase above the next biggest competitor in Warner Bros.

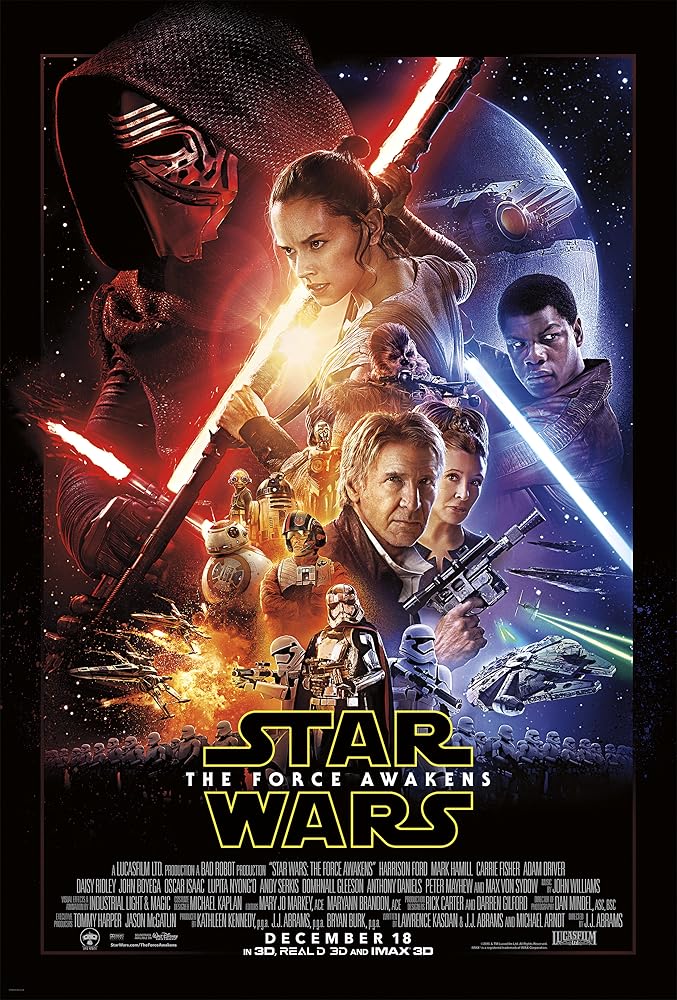

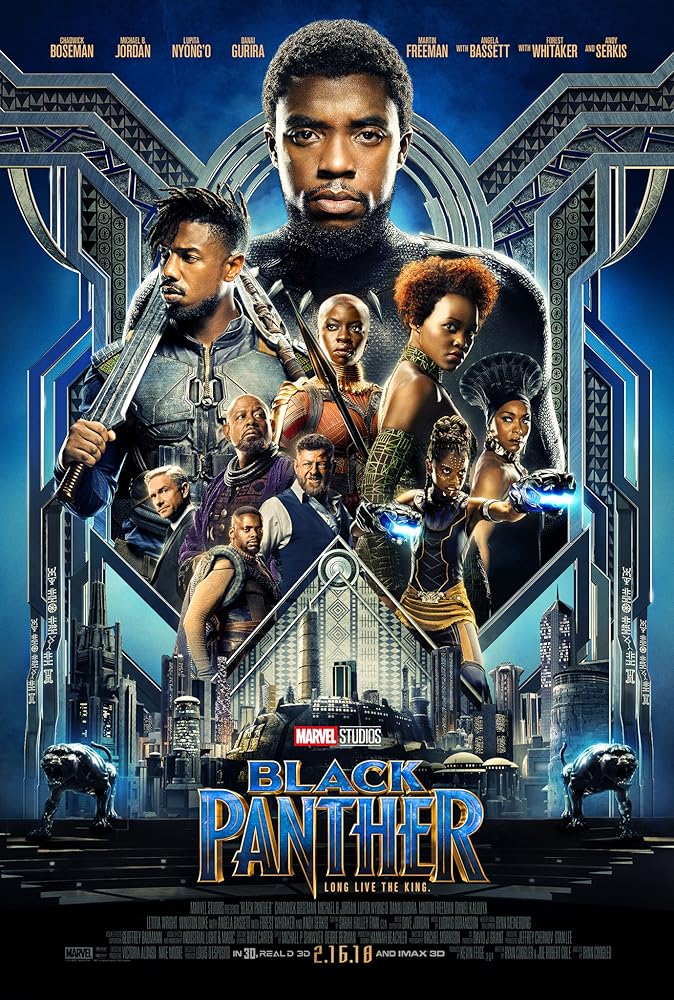

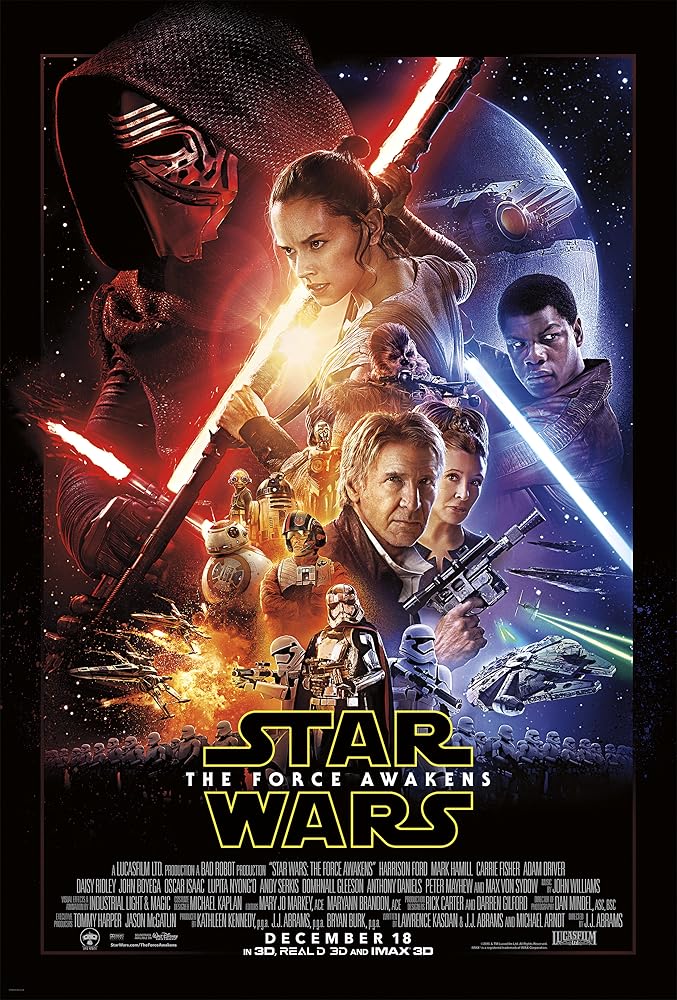

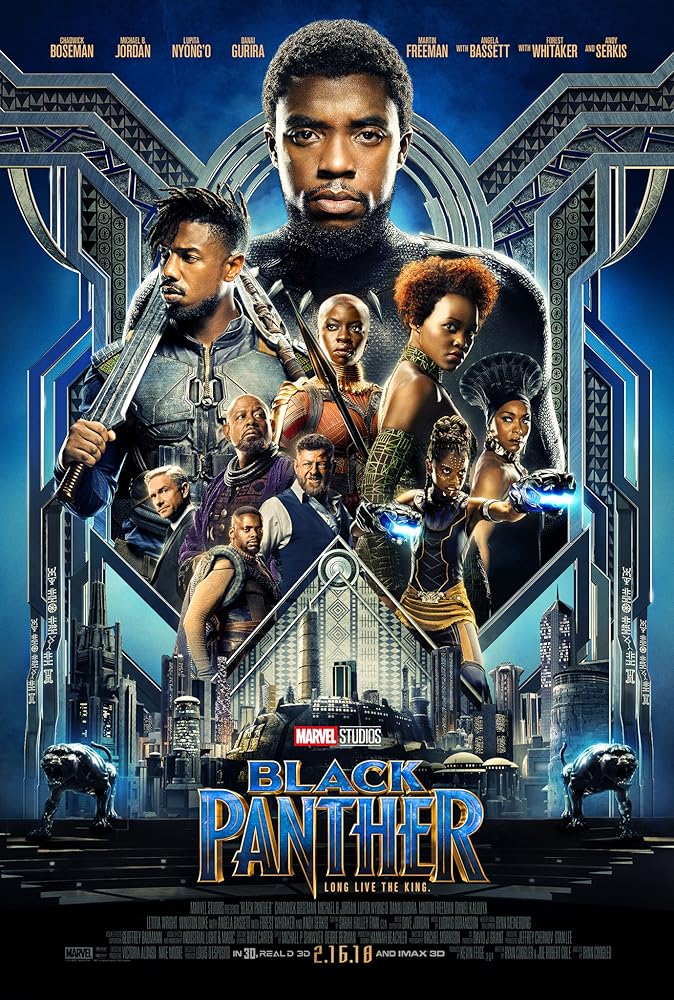

How did they do it? They acquired Pixar, Marvel, LucasFilm, and 20th Century Fox, but the most gains as of late have been through Marvel with the Marvel Cinematic Universe producing the most profitable (Avengers: Endgame) and iconic (Black Panther) films of the past decade.

Acquiring a company should not be viewed as an easy cop out to boost creative content. As big of a conglomerate is The Walt Disney Company, it does take significant effort to ensure the acquistions are managed properly and that the creativity of its members are not squandered. Ultimately the people are the main assets of a company and not the rights to a fictional character. It's something Bob Iger emphasized in his book, The Ride of a Lifetime. Ultimately, Iger was able to help leverage the company's acquisitions to grow his company and pull far ahead of the Big Six.

How did they do it? They acquired Pixar, Marvel, LucasFilm, and 20th Century Fox, but the most gains as of late have been through Marvel with the Marvel Cinematic Universe producing the most profitable (Avengers: Endgame) and iconic (Black Panther) films of the past decade.

Acquiring a company should not be viewed as an easy cop out to boost creative content. As big of a conglomerate is The Walt Disney Company, it does take significant effort to ensure the acquistions are managed properly and that the creativity of its members are not squandered. Ultimately the people are the main assets of a company and not the rights to a fictional character. It's something Bob Iger emphasized in his book, The Ride of a Lifetime. Ultimately, Iger was able to help leverage the company's acquisitions to grow his company and pull far ahead of the Big Six.

The Golden Age of Disney

Based on The-Numbers, the Big WB (Warner Bros) distributed 802 movies over the last 25 years, on average 32 movies a year, the most out of any studio. While quantity will help sales as we've seen, quality and popularity travel further. Walt Disney Pictures' dominance can be summarized by these six movies below over the last 6 years. Each of these six movies below became the #1 movie in America within their respective years:

Just 2 of the above 6 movies alone, Star Wars: The Force Awakens (2015) and Avengers: Endgame (2019), grossed over $4.86 billion in box office revenue worldwide, which adds up to 12% of Walt Disney's Total Box Office revenue over the last 25 years.

Now at $39.7 billion in total box office and a strong 17% share of the market, Disney leads all distributors into the 2020s while distributing 200 fewer films than it's next closest competitor (WB). This amount of money The Walt Disney Company has made was something their board needed after agreeing to pay billions of dollars to acquire 4 new companies. It appears it paid off.

Now at $39.7 billion in total box office and a strong 17% share of the market, Disney leads all distributors into the 2020s while distributing 200 fewer films than it's next closest competitor (WB). This amount of money The Walt Disney Company has made was something their board needed after agreeing to pay billions of dollars to acquire 4 new companies. It appears it paid off.

The Former Years of Warners Bros Films

As you can tell from the graphs from before, for years Warners Bros has been THE distributor of movies, releasing the highest amount for 13 straight years from 1995 - 2007. Sixteen of the last 25 years have been all Warner Bros as they pumped out more movies than any other Big 6 distributor.

Some of Warner Bros. most successful films over the last two and a half decades have been the ones below:

Some of Warner Bros. most successful films over the last two and a half decades have been the ones below:

This is far from implying that their saga is over. In fact, with Tenet and Wonder Woman 1984 coming up in 2020, they might just see their best year since 2016's Batman v Superman and Suicide Squad, which flopped in critic reviews but still made money.

Warner Bros is the closest studio to catching up to Disney, but Disney isn't showing any signs of slowing down, especially with Phase 4 of the Marvel Cinematic Universe fast approaching starting with Black Widow (expected Nov 2020).

Warner Bros is the closest studio to catching up to Disney, but Disney isn't showing any signs of slowing down, especially with Phase 4 of the Marvel Cinematic Universe fast approaching starting with Black Widow (expected Nov 2020).

Is Universal Pictures Making a Comeback?

During the pandemic, Universal not only announced the release of their new streaming service, Peacock, they also just made public that there will be a reboot of Scarface (1983). Last year Universal also distributed 21 films, the most out of any distributor in 2019. It's clear from these actions that the company is looking to expand many parts of its business to compete with Warner Bros and Disney.

While Revenue per Film has shown a decline over the past 3 years, Universal's ambition may soon yield some very interesting results content and technology-wise.

Steady Sony...

Sony Pictures, the next closest competitor, has had a relatively flatter curve in terms of Revenue per Film, which shows they are consistent and makes them a safe bet. While the data suggests they are likely to maintain this decent trend of $75 million average box office revenue per movie per year, it doesn't appear like it's heading in any dramatic direction.

We all love a good Spider-Man movie as much as the next guy, and Sony Pictures has distributed a lot of great content over the years: A Beautiful Day in the Neighborhood (2019) and Casino Royale (2006) to name a couple. Perhaps the 18 films they distributed in 2019, the most since 2012, is a sign of growth, and it is also impressive to see that they have maintained a strong 3rd place position behind Warner Bros and Walt Disney for 15 straight years.

What does the Future Hold? Mergers & Acquisitions?

So what does the future hold for movie distributors? At $40 billion in total box office revenue and a $5 billion cushion ahead of Warner Bros, Disney's movie entertainment future shines bright like a diamond. It definitely helps that its latest acquisition of 20th Century Fox will further grow its rich pool of creative content.

There have been some articles about mergers and acquisitions becoming almost an ideal strategy for not just media companies but all businesses to deploy to outlast the competition. From the Observer.com article,

"...the M&A opportunity lies not within technology or a specific industry, but at the intersection of them both"

~Mark Williams, Chief Revenue Officer, Americas, Merrill Corporation

With the higher demand for faster and better technology, we can speculate that companies would rather acquire companies that have already developed the technology rather than figure it out on their own, which would take years of resources.

A senior financial analyst in the article said that Netflix may look for additional acquisitions, which leads to another question: How much will Netflix eat away at the box office revenue of the Big Six?

It's an exciting but uncertain time, and as consumers, all we can hope for is that content is respected. As soon as businesses sacrifice quality over quantity, people will look elsewhere for entertainment.